The wood products industry has become a multinational business with plantations and mills around the U.S and the World. By 2007, there were 38,614 firms with shipments valued at $186,7 billion and employment of 1,037,806 people (United States Census Bureau, 2007)

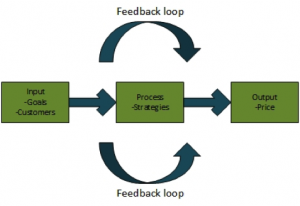

Marketing is easily misunderstood as a process of telling and selling products but it must be understood as a new sense of “satisfying customer needs”. (Armstrong & Kotler, 2005). Moore & Pareek (2006) mentioned that marketing has two goals: (1) first, attract new customers by emphasizing the value of the product or service offer by the company and (2) second, retain the current customer and keep satisfying the customer with old and new products and services.

By conducting marketing activities in the wood products industry new and different information can be obtained. According to Dasmohapatra (2009), the North America forest products industry is losing its domestic markets to a slow economy and high manufacturing costs causing the close of many mills and many workers losing their jobs in recent years. Dasmohapatra also argues that the new marketing drives or new era of the forest products industry relies in opening the minds to global markets, targeting products to changing demographic structure and customers taste, designing products with environmental taste, innovation, efficient management, trade practices, and policies.

Anderson, et al. (2005) developed a study about current consumer behavior in forest products. The study focused on how forest firms can satisfy consumer’s wants and needs. Results show that this is possible only if the firm focuses on understand consumer behavior. Regarding the method used (mail survey or mall intercept methods) researchers need to cautiously control the bias in the data that is typically used in forest products business/marketing field. The two most important results found by Anderson, et al. (2005) were: 1)researches will need to adapt their efforts to incorporate the networking aspects, and 2)surveys have been and will continue to be, a mainstay in forest products marketing research.

References:

- Anderson R, Fell D, Smith R, Hansen E & Gomon S. (2005). Current Consumer Behavior Research in Forest Products. Forest Products Journal. Vol.55 No.1, PP. 21-27

- Armstrong, G & Kotler, P. (2005). Marketing: an introduction. Pearson; Prentice Hall. 7th ed. Upper Saddle River, New Jersey.

- Dasmohapatra, S. (2009). Future marketing drivers for the forest product industry. BioResources. Vol.4 No.4, PP. 1263-1266 Retrieved February 5, 2013 from http://su8bj7jh4j.search.serialssolutions.com.

- Moore, K & Pareek, N. (2006) The basics Marketing. Routledge. New York, NY.

- United States Census Bureau (2007). Retrieved December 5, 2012, from Us. Department of Commerce website: http://www.census.gov